Fannie Mae 1005 1996-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

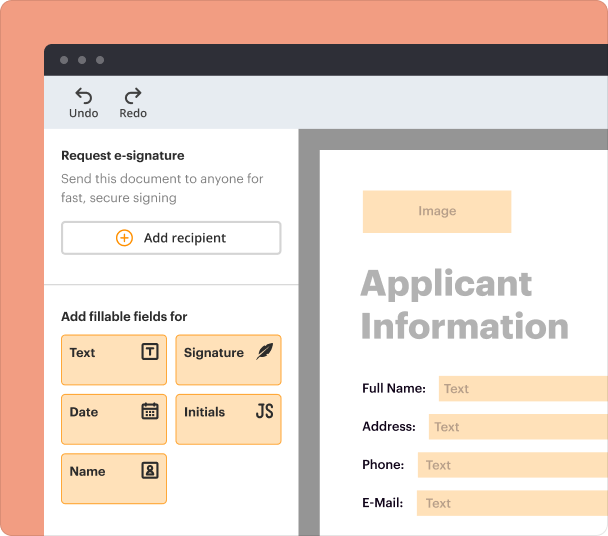

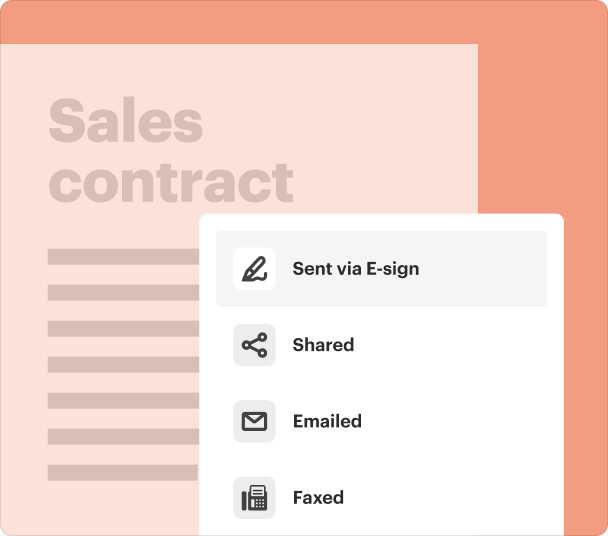

Edit and sign in one place

Create professional forms

Simplify data collection

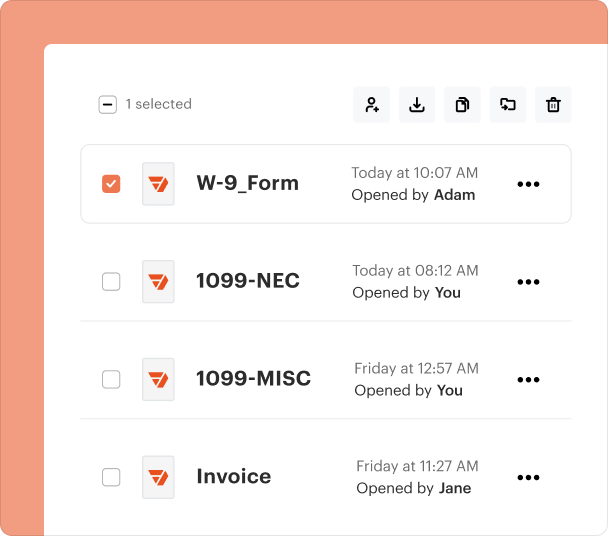

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

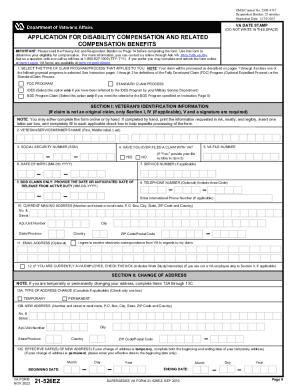

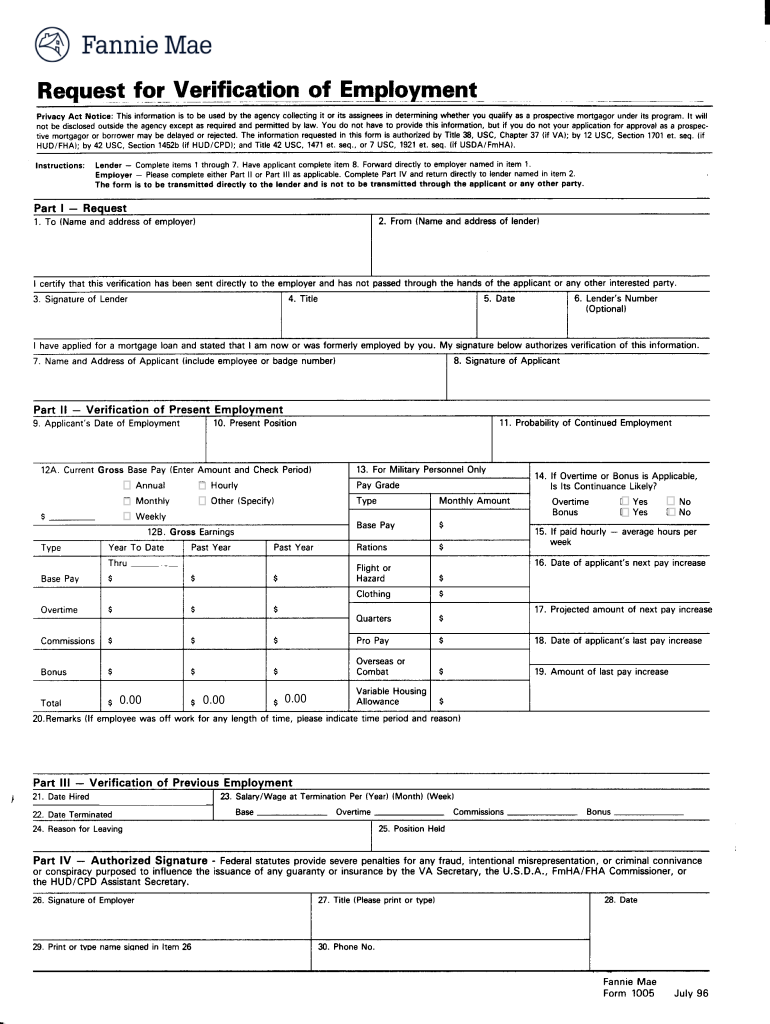

Detailed Guide to Form 1005: Verification of Employment

How does Fannie Mae Form 1005 work?

Fannie Mae Form 1005 is pivotal in verifying employment during mortgage applications. It streamlines the verification process for lenders and borrowers, ensuring both parties have reliable employment data. This form is particularly crucial between 1996 and 2025, as it aligns with regulatory requirements for mortgage processing.

What are the key components of Form 1005?

Form 1005 consists of important fields that require precise information regarding the borrower's employment. Each section plays a unique role in confirming employment status, income details, and the borrower's reliability. Completing this form accurately can prevent delays in the mortgage approval process.

-

Enter the full name and current address of the borrower.

-

Include the employer's name, address, and contact number.

-

Provide salary information and additional income, if any.

How do fill out Form 1005 step-by-step?

Filling out Form 1005 requires attention to detail. Borrowers must ensure they provide accurate information and necessary signatures. Lenders should follow clear guidelines when sending out employment verification requests, especially when dealing with multiple employments spanning the past two years.

-

Ensure that the borrower signs and dates the form.

-

Lenders should outline how to approach employers for verification.

-

List all past employers within the last two years with correct timelines.

What are the printing and submission requirements?

Specific printing instructions are crucial for Form 1005 to be accepted. The form must be printed on letter-size paper in portrait format. Submissions involve both employers and lenders, so it’s essential to follow the correct process to avoid discrepancies.

-

Use letter-sized paper and portrait mode for printing.

-

Employers must send forms directly to the lender to maintain accuracy.

-

Address any inconsistencies in information promptly to avoid delays.

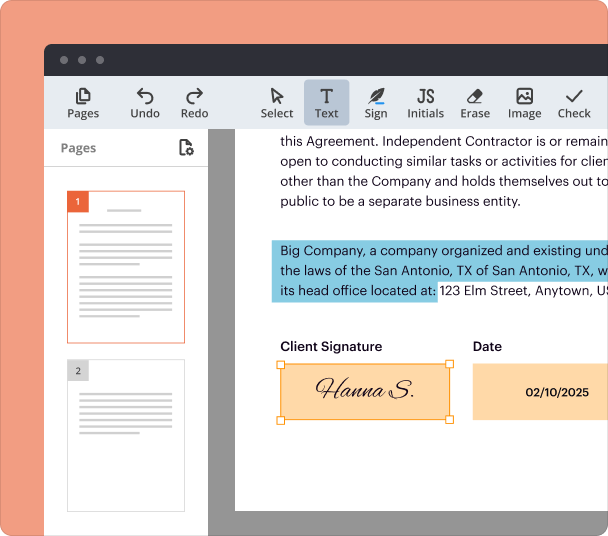

How can pdfFiller help with Form 1005?

Using pdfFiller, you can easily edit and eSign Form 1005. This platform simplifies collaboration and document management through features that allow you to store forms securely in the cloud. With pdfFiller, users can manage forms effectively without the hassle of physical paperwork.

-

Make necessary edits directly on the platform before finalizing your form.

-

Sign forms online without the need for printing.

-

Keep your documents safe and accessible from anywhere.

What compliance considerations should keep in mind?

Compliance with state-specific documentation requirements is essential when completing Form 1005. Understanding the legal implications of inaccuracies is vital to protect both lenders and borrowers. Following best practices for compliance ensures a smooth mortgage process and mitigates potential risks.

-

Different states might require additional documentation; verify requirements in your state.

-

Inaccuracies in the form can lead to complications in mortgage approval.

-

Stay updated with regulations to ensure adherence to lending standards.

Frequently Asked Questions about fannie mae voe form

What should I do if my employment status changes during the application process?

If your employment status changes, immediately inform your lender. They may require updated verification to proceed with your mortgage application.

How should I address an employer who refuses to complete the verification?

Contact your lender for guidance. They may have alternative methods to verify your employment or be able to advise on how to persuade your employer.

Is there a specific timeline for completing and submitting Form 1005?

While there is no fixed timeline, it is advisable to complete and submit the form as soon as possible to avoid delays in your mortgage application.

Can I use pdfFiller to edit the form after it's signed?

Once a form is signed, editing may not be possible without invalidating it. However, when using pdfFiller, you can create a new version of the form for additional changes.

What are common mistakes to avoid when filling out Form 1005?

Common mistakes include incomplete fields, incorrect employment dates, and failing to provide signatures. Double-check all entries to ensure accuracy before submission.

pdfFiller scores top ratings on review platforms