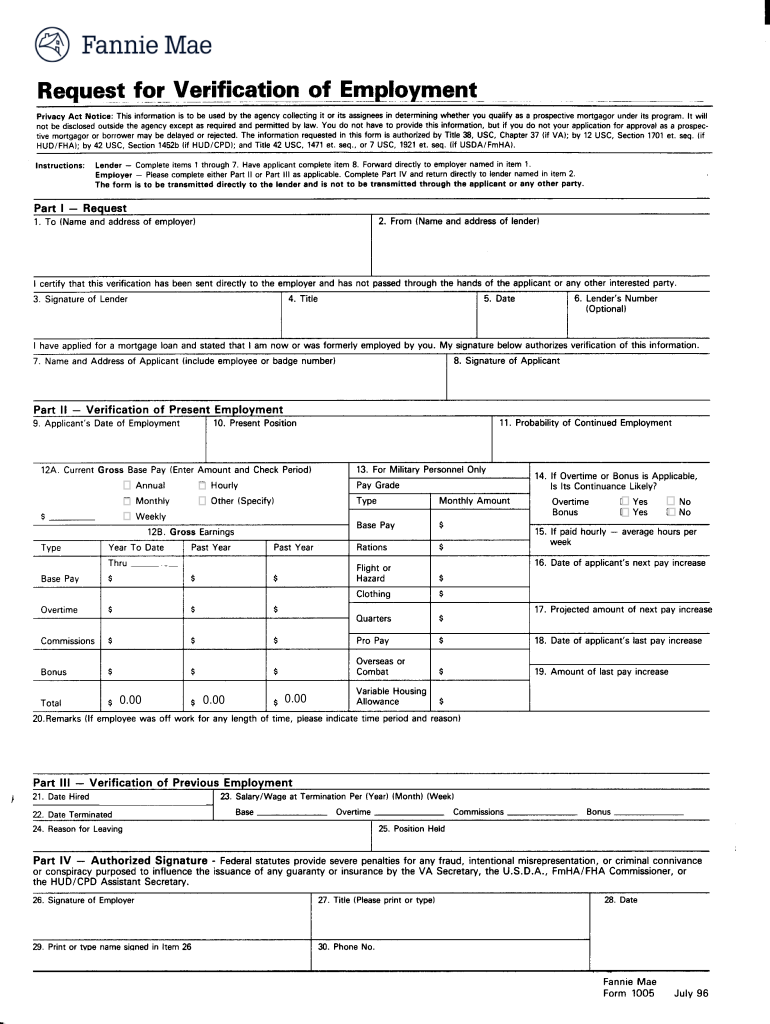

Who needs a Fannie Mae form 1005?

This form is used by the lender to verify the employment status of the person who wants to receive a first or second mortgage. The lender sends the request directly to the applicant’s employer. The verification must also be sent directly to the lender.

What is the purpose of the Fannie Mae form 1005?

The request for verification of employment is sent to receive verification of the borrower’s salary, overtime, bonus and commissions. Before giving a loan to an individual, the creditor wants to get as much information about him as possible. The verification of employment is one of the most important pieces of evidence regarding the applicant’s responsibility and paying capacity.

What documents must accompany the Fannie Mae form 1005?

As a rule, there is no need to attach other forms to the request form. The employer may need additional documents to verify this form, if there is a need.

How long does it take to fill the Fannie Mae 1005 form out?

The estimated time for completing the form by the employer is 10 minutes. The form is submitted whenever the individual files the application for a loan.

What information should be provided in the Fannie Mae 1005 form?

The form consists of four parts: the request, the verification of present employment, verification of previous employment, authorized signature

The request part is completed by the lender who adds the following information:

- Name and address of the employer

- Name and address of the lender

- Number of the lender

- Name and address of the borrower

The lender also has to indicate the title, sign and date the request.

The applicant (the borrower) must sign the form as well.

The verification parts are completed by the employers who provide the following information:

- Date of the applicant’s employment

- Present position

- Probability of continued employment

- Current gross base pay

- Overtime bonus (if applicable)

- Information about the pay increase

- Information about the previous job (if applicable)

The employer must also sign and date the form.

What do I do with the form after its completion?

The request is forwarded to the applicant’s employer(s). The verification form is retained by the lender in its mortgage file.